Events & Contributions By Piroska Nagy-Mohacsi

Learn more about press pieces and events that Piroska Nagy-Mohacsi has been featured in!

Managing the Megacrisis of 2022

July 19, 2022, Project Syndicate

At recent gatherings of G7 leaders, NATO members, and G20 foreign ministers, it was clear to everyone that the world is facing a confluence of emergencies unlike anything we have seen in decades. International tensions have risen to alarming heights on the back of increasing food and energy insecurity, depreciating currencies, looming debt crises, the ongoing COVID-19 pandemic, the intensifying effects of climate change, and armed conflicts.

Old and New Challenges for Central Banking in West Africa

June 21, 2022

To mark the Bank of Ghana’s 65th anniversary, we explore financial and economic prospects for the region’s emerging economies, the impact of COVID-19 on development prospects, and more.

Is the World’s Reserve Currency In Trouble?

True, America’s deep and highly liquid financial markets, investment-quality dollar-denominated assets, and the rule of law make the dollar the preferred global currency for commerce and trade. There is no obvious contender.

Planning for the Post-COVID world: central bank policies in emerging economies

Contributor(s): Professor Piroska Nagy-Mohácsi, Professor Ricardo Reis, Gent Sejko

Regulatory Tolerance for Cryptocurrencies

March 15, 2018

The Wall Street Journal: Governments shouldn’t rush to clamp down on cryptocurrencies, which are a source of needed innovation and competition, Ousmène Jacques Mandeng and Piroska Nagy-Mohacsi write.

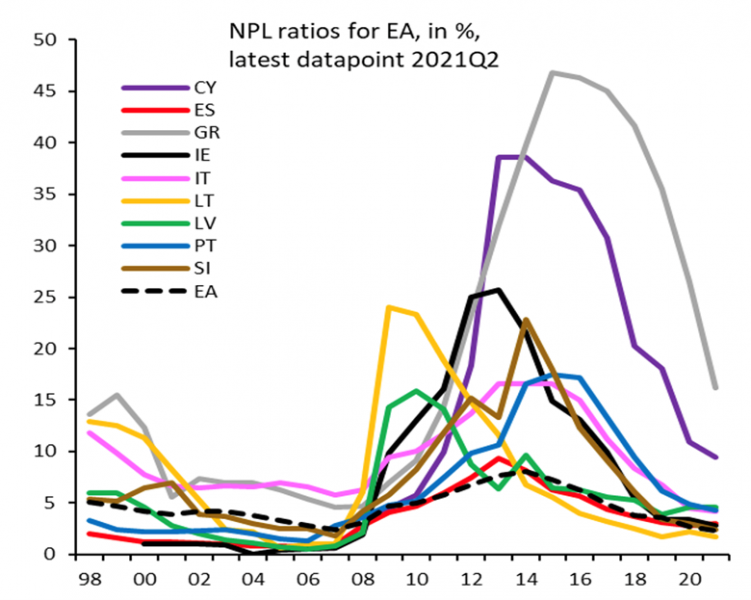

Nonperforming Loans in Asia and Europe— Causes, Impacts, and Resolution Strategies

Piroska Nagy-Mohacsi outlined a strategy of how to deal with COVID-related non-performing loans in a webinar organized by the ADB and the European Central Bank on December 13, 2021.

The New Crisis Of Central Banking

February 6, 2022

Piroska Nagy-Mohacsi and Mario I.Blejer discusses the impacts that COVID-19 has had on inflation, and why its considered a new crisis in central banking.

The COVID Non-Performing Loan ’Tsunami’ that Never Happened and How to Avoid it Now

February 2022:

Initial fears of rapidly worsening bank asset quality and an ensuing ‘Non-Performing Loan (NPL) tsunami’ from the COVID-19 pandemic have not materialised so far. In Europe, this is mainly due to the unprecedented mix of policy support measures that European governments have implemented, including, for the first time, wide-ranging measures at the European level. However, economic uncertainties related to new COVID variants persist and remaining COVID-support measures will need to be withdrawn at some stage.

The Euro in 2022

Fundación ICO and Fundación de Estudios Financieros jointly decided in 2012 to publish an annual review of the Euro, the Yearbook, with the aim of expanding knowledge and raising awareness of the single currency, and suggesting ideas and proposals for strengthening its acceptance and sustainability